Download a PDF Copy of this report

Markets maintain momentum in February

Getting more defensive as valuations again become overcooked…

The market rally that started in January kept on rolling through February with all major markets ending the month higher. The S&P 500 gained 3.2% in U.S. dollar terms, while the MSCI EAFE Index rose by 2.6%.

The Canadian dollar declined slightly in the month, boosting gains in Canadian dollar terms. With the effects of currency moves taken into account, the S&P 500 was up 3.5% and the MSCI EAFE Index rose 2.9% in Canadian dollar terms.

Bonds ended slightly higher, with the FTSE/TMX Canada Universe Bond Index ending February up 0.2%. Corporate bonds outperformed government issues as tight supply pushed corporates higher.

Helping to fuel the rally were comments from central banks, particularly the U.S., Federal Reserve, that they would continue to exercise caution and patience. This led investors to believe rates were likely on hold for the immediate future.

Markets also cheered the prospects that a trade and tariff deal could be reached between China and the U.S. Reports seemed to indicate a deal could be reached within weeks. But as of mid-March, a meeting had again been postponed.

Canadian equities were pushed higher on the back of a nice rebound in the price of oil. OPEC reiterated its plans to curb production, which pushed crude oil up more than 6% in the month. This saw Canada’s heavyweight energy sector also gain nearly 6% on Toronto’s TSX exchange.

The Canadian dollar weakened against the U.S. greenback as the differential between West Texas Intermediate crude oil and Western Canadian crude widened, putting pressure on the loonie. In addition, the Canadian economy struggled in the final quarter of 2018 as several areas including consumer spending, business investment, and residential investment, retreated.

Despite this setback, the outlook for Canada remains upbeat as strong growth south of the border combined with a competitive dollar paint a strong picture for exports. In the U.S., economic numbers show a strong, but slowing economy. China’s economy which had been languishing in recent months, showed signs of a recovery.

In this environment, I continue to favour equities over bonds, although only slightly. At this point in the cycle, I favour more defensive types of funds, including many of the low-volatility and dividend-focused funds. I have a slight tilt towards U.S. equities, but I may move to more neutral positioning if we continue to see valuations pushed higher.

| Underweight | Neutral | Overweight | ||

| Cash |

X |

|||

| Bonds |

X |

|||

| Government |

X |

|||

| Corporate |

X |

|||

| High Yield |

X |

|||

| Global Bonds |

X |

|||

| Real Ret. Bonds |

X |

|||

| Equities |

X |

|||

| Canada |

X |

|||

| U.S. |

X |

|||

| International |

X |

|||

| Emerg Markets |

X |

|||

Within fixed income, I continue to favour lower-duration, higher-quality issues. I remain underweight high-yield issues, because if we see a meaningful slowdown, there are a significant number of BBB-rated issues that may be downgraded, putting pressure on prices and pushing up yields.

In this environment, I remain consistent with my investment outlook, as shown in the accompanying allocation matrix.

Please send your comments to feedback@paterson-associates.ca.

Factor-based investing

Taking a closer look at this not-so-new investment technique…

Maybe you’ve seen those Fidelity commercials on TV. They start with a bunch of math formulas and scare you into thinking that investing is very complicated after a very high-level explanation of factor-based investing. Then it cuts to a lot of good-looking people pointing at things. While the production values are pretty slick, I’m not sure it really does a good job explaining what factor-based investing is, or more to the point, why you should care.

Factor investing may seem to be a new concept, but in reality, it’s been around longer than many realize. Value investing, or the concept of buying a stock well below what you believe it to be worth, is a type of factor-based investing. In very simple terms, factor-based investing screens securities for different characteristics that have historically been shown to lead to strong returns over periods of time. There are literally hundreds of different factors, but there are really five main ones.

Value – This involves buying securities at prices you believe are below what you believe them to be worth. The evidence shows that over time, stocks that trade at lower valuation have earned higher returns than more richly-valued stocks.

Momentum – In very simple terms, momentum investing is like trend-following. The goal is to buy stocks that are experiencing rising share prices. This is based on the premise that stocks that have had strong recent price performance have historically earned higher returns than those experiencing poor recent performance.

Volatility – Historically we have been led to believe that to earn a higher return, you need to accept a higher level of risk. The volatility factor, to some extent, turns that belief upside down. With volatility investing, you are looking to invest in the stocks that have experienced the least amount of price fluctuation over a certain period of time. Research has shown that stocks that exhibit lower volatility have historically outperformed more volatile stocks over time in most market conditions.

Quality – Quality investing looks for companies that are fundamentally strong and exhibit such characteristics as high return on equity, low debt to equity, and low levels of earnings variability. Evidence shows that stocks that score well in the quality factors have historically outperformed those with poorer quality scores.

Size – Another well-known factor is based on the belief that smaller companies have historically outperformed their larger brethren over the long-term.

There is a large and growing body of research that shows each of these factors has demonstrably added incremental return over time. If you really think about how factors work, it is much like how many active managers run their funds. They look for stocks that exhibit certain characteristics and size them based on their conviction. In comparison, a factor-based investment screens the universe on the various factors and then weights the stocks based on the relative attractiveness.

The challenge with factor-based investing is that there are going to be periods of time when the strategies outperform or underperform. The point is that while factors have the potential to outperform the broader markets over time, there will be periods when they are in and out of favour.

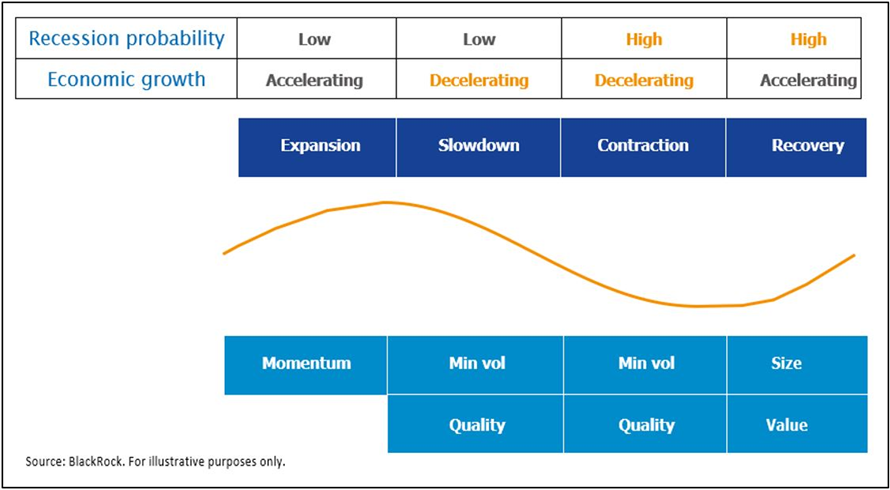

Different factors have historically performed better in different market and economic environments. For example, as the economy begins to slow, low volatility and quality factors have outperformed. Conversely, when markets are on the way up, small cap, value, and – later in the cycle – momentum factors outperform.

The accompanying graph shows historically which of the factors have outperformed in different market and economic environments. This shows which factors you would want to emphasize based on the market environment. Right now, with all signs pointing towards our being late cycle, you would want to tilt the portfolio towards low volatility and high-quality investments.

The accompanying graph shows historically which of the factors have outperformed in different market and economic environments. This shows which factors you would want to emphasize based on the market environment. Right now, with all signs pointing towards our being late cycle, you would want to tilt the portfolio towards low volatility and high-quality investments.

How to access factors

There are many ways to access factors when investing. In the mutual fund space, there are many active managers who run with a quality or value bias to their portfolios. Some will use momentum in their trading strategies. There are also many small- and mid-cap options available to allow you to capture the size factor. For low volatility, many new offerings focusing on this factor have been launched in the past few years.

However, to get pure factor exposure, you will likely want to look to the ETF space as there are many different options available from most of the bigger ETF providers. The challenge when using the ETFs is to understand the key differences in the construction methodology in each and how that will affect the returns over time.

Bottom line

While it’s currently being pitched as the hot new trend in investing, factor-based investing has been around for a long time in many different forms. Depending on which funds you hold, you may already have significant exposure to the different factors, and many active managers use some form of factor analysis in their research process.

Factor-based investing can help improve returns and reduce volatility, but it is a tool, not a magic bullet. You still need to have diversification across different asset classes, geographic regions, industry sectors, as well as factors.

I like to use factors as a way to help tilt the portfolios based on the current and expected market environment. For example, I believe we are late in the cycle, so my portfolios tend to tilt more towards low volatility and higher quality. As the market cycle turns, I’m very likely to put on a small-cap and value tilt to take advantage of the more attractive valuation profile.

Funds of Note

This month, Fiera’s rebranded Canoe funds and Mackenzie’s new ESG funds…

Fiera Funds rebranded to Canoe

Last October, Canoe Financial announced that it was acquiring the retail mutual fund assets of Fiera Capital. That transaction was completed in February and resulted in several name changes, including the Fiera Capital Global Equity Fund being renamed the Canoe Global Equity Fund, and the Fiera Capital Equity Growth Fund being renamed the Canoe Canadian Small Cap Fund.

There is not expected to be any material change to the investment mandates of the funds nor will there be any change to the portfolio management teams or their investment processes.

We are continuing to monitor the funds closely.

Mackenzie adds to ESG fund lineup

ESG (Environmental, Social, Governance) investing continues to gain in popularity as investors are holding corporations responsible for their actions. In response, many fund companies are bolstering their ESG offerings.

Late last year, Mackenzie Financial added the Mackenzie Global Environmental Equity Fund to its stable of ESG offerings.

Managed by Toronto-based Greenchip Financial, the fund invests in a concentrated portfolio of 30 to 35 companies that generate their revenues from environmentally-superior products and services.

Typically, these companies will be operating in sectors like clean energy, clean technology, water, energy efficiency, sustainable agriculture, and transportation.

The manager starts with roughly 600 global companies and screens them based on their contribution to the environment. They also consider the fundamental strength of the company, focusing on margin expansion, revenue growth, cash flow, and balance sheet strength.

Next, the managers conduct a more intensive due diligence review that drills deeper on the business model and helps determine their estimate of fair value. Companies are ranked on their discount between the market price and their estimate of fair value.

The result is a portfolio diversified across geography, market capitalization, and sector.

While this fund is new, the manager has been running a comparable mandate since November 2008. Since its launch, the fund has roughly tracked the index on a gross of fee basis. The fund carries an expected MER of roughly 2.5% for advisor-sold units and 1.05% for fee-based units.

It’s too early to have a strong opinion on the fund, but given the historic return of the mandate, this may be one to watch for those investors looking for more ESG exposure.

If there is a fund that you would like reviewed, please email a request to me at feedback@paterson-associates.ca

March’s Top Funds

Dynamic Global Infrastructure Fund

| Fund Company | Dynamic Funds |

|---|---|

| Fund Type | Global Infrastructure Equity |

| Rating | B |

| Style | Large-Cap Growth |

| Risk Level | Medium |

| Load Status | Optional |

| RRSP/RRIF Suitability | Good |

| Manager | Oscar Belaiche since July 2007 |

| Frank Latshaw since Jan. 2016 | |

| MER | 2.38% |

| Fund Code | DYN 2210 – Front-End Units |

| DYN 7114 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: Despite a tendency to underperform in bull markets, infrastructure may yet have its day as market volatility is poised to pick up and the sector’s stable returns start to look a lot more attractive.

Global infrastructure investments offer stable growth by providing exposure to sectors that need to be maintained regardless of how the economy is performing, to markets with growing demand as global population increases, and to stable returns over the course of lengthy projects.

Furthermore, infrastructure investments have a relatively lower correlation to the broader equity markets as company revenues are often linked to price increases thanks to the monopoly power of many infrastructure companies and explicit utility pricing legislation. This is also an advantage when inflation picks up and interest rates rise as infrastructure companies can recover shareholder value through corresponding price increases more quickly than other companies can.

One of the strongest performers in the category is the Dynamic Global Infrastructure Fund. At the helm for 12 years, co-manager Oscar Belaiche has produced superior risk-adjusted performance, including a six-month gain of 5.8% and a one-year return of 13.1% as of Feb. 28.

This low-turnover fund has held some names for many years allowing the holdings to compound in value uninterrupted by sentiment-based trading. The management team is aware that the fund’s size ($1.3 billion) can have an impact on market prices and so aims to keep turnover to a minimum.

The sector faced headwinds in 2018, including the challenging regulatory environment which impacted the energy sector and rising interest rates, which hit utilities. However, this created an excellent opportunity to pick up some high-quality names at very attractive prices. The managers continue to favour companies with an emphasis on low-cost renewable power generation.

The managers remain optimistic on infrastructure including energy infrastructure, believing that volume growth will be strong. Further, they believe that current valuation levels are compelling, particularly if growth picks up.

.

Manulife Dividend Income Plus Fund

| Fund Company | Manulife Investments |

|---|---|

| Fund Type | Canadian Focused Equity |

| Rating | A |

| Style | Mid-Cap Growth |

| Risk Level | Medium-High |

| Load Status | Optional |

| RRSP/RRIF Suitability | Good |

| Managers | Duncan Anderson since July 2012 |

| Alan Wicks since July 2012 | |

| MER | 2.30% |

| Fund Code | MMF 4548 – Front-End Units |

| MMF 4748 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: Managed by the same team as one of my favorites, the Manulife Dividend Income Fund, this all-cap fund uses a unique multi-step approach that looks to fully understand the value of a business.

The managers score each company on several factors, e.g., stability and level of earnings power, managerial skill and ownership, and financial leverage, helping to determine an estimate of fair value. This helps to determine buy and sell prices. A deeper due diligence review is conducted on the most attractive opportunities, including meetings with management.

With a view to significant diversification across business risk and return drivers, their methodology results in sector weightings that are significantly more balanced than the S&P/TSX Composite index which is overweight energy and financials. The managers actively monitor position sizes and make trades if they believe a holding has become over- or undervalued.

The portfolio consists of roughly 60 names, with the top 10 making up about 38% of assets. It was recently overweight consumer services, technology, and industrials, and significantly underweight healthcare and basic materials.

As at January 31, the fund was 60% invested in Canadian equity, 24% in U.S. equity, 8% in international equities, and the balance in cash and other assets.

Despite recent volatility, long- and short-term performance has been excellent. As of Feb. 28, it delivered a trailing one-year return of 6.6%, compared with 6.9% for the S&P/TSX Composite Index, and boasts a 5-year average annual compounded rate of return of 11.5% compared with 5.5% for the index.

Though the fund has been more volatile than the index, it has done a great job protecting capital in down markets. Over the most recent trailing 5-year period, it has captured roughly 105% of the market upside, while capturing only 48% of the downside.

Although I still lean towards its sister Manulife Dividend Income Fund, this one is a good option and can be a great core holding for investors with an above-average tolerance for risk.

.

Mawer U.S. Equity Fund

| Fund Company | Mawer Investment Management |

|---|---|

| Fund Type | U.S. Equity |

| Rating | D |

| Style | Large-Cap Growth |

| Risk Level | Medium |

| Load Status | No Load |

| RRSP/RRIF Suitability | Good |

| Manager | Graydon Witcher since May 2009 |

| Colin Wong since January 2016 | |

| MER | 1.16% |

| Fund Code | MAW 108 – No-Load Units |

| Minimum Investment | $5,000 |

Analysis: Managed by Mawer’s Graydon Witcher and his team since May 2009, this fund’s bottom-up research driven investment process looks for well managed companies with a history of attractive return on capital, strong balance sheets, and a record of delivering strong operational and financial results. Valuation is a consideration, and the manager aims to buy names trading below their estimate of true worth.

The manager does extensive research on the company, its management, and its competition, stress testing their models through intensive scenario analysis for a deeper understanding of a company’s fundamentals and valuation. The process is long-term focused and very patient, with portfolio turnover averaging less than 25% for the past five years.

The result is a well-diversified portfolio that holds roughly 60 names, with the top 10 making up a third of the fund. Sector positions are capped at 20% of the fund based on book value. And at the end of December, financials were the largest sector, at just under 20% of assets. Tech and healthcare were next largest, at 17.5% and 15%, respectively.

While the manager believes the trade war has been a drag on economic activity and is likely to be a headwind until a deal is reached, he still expects the U.S. to perform well with its structural advantages, looking to the broader economy and the credit cycle as the main drivers for U.S. growth.

The fund is defensively positioned, and currency exposure is unhedged. The rationale is that the U.S. dollar is a reserve currency with safe-haven status in times of market selloffs. This is expected to lead to better returns in Canadian dollars.

Short- and long-term performance has been excellent, with the fund has delivering top-quartile performance over the past 3-, 5-, 10- and 15-year periods. Volatility has been slightly lower than the index, resulting in better risk-adjusted returns compared with the peer group.

While it’s difficult to add value in U.S. Equity, this fund, with an MER of 1.16%, is an excellent choice. For those working with an advisor, a fee-based version is available as the Manulife U.S. Equity Fund at a slightly higher cost.

.

Fidelity Global Innovators Fund

| Fund Company | Fidelity Investments Canada |

|---|---|

| Fund Type | Canadian Neutral Balanced |

| Rating | C |

| Style | Large-Cap Blend |

| Risk Level | Medium |

| Load Status | Optional |

| RRSP/RRIF Suitability | Good |

| Manager | Geoff Stein since February 2015 |

| David Wolf since February 2015 | |

| MER | 2.06% |

| Fund Code | FID 282 – Front-End Units |

| FID 082 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: While growth stocks have consistently rebounded from selloffs for the past few years, they will eventually give up market leadership as investors rotate away from unsustainably elevated valuations. Mark Schmehl since its inception this is one of the stronger performers in the Global Equity category since December’s market lows.

Schmehl uses a slightly unconventional approach, looking for innovative companies that are undergoing some sort of fundamental change he believes will be a catalyst to unlock share price appreciation and ideally deliver above-average growth over the next 12 to 18 months. Along with traditional valuation metrics, Schmehl also plays momentum and conviction, looking to get in early on the next big trend and letting his winners to run, regardless of the valuation.

He is also a very active with portfolio turnover often well above 100%. At the end of January, the fund had 11% in Canadian equity and 81% in foreign equities, with tech the largest sector, comprising nearly 51% of assets. Surprisingly, consumer cyclical is the next largest sector at 34%, reflecting the manager’s seeking out under-the-radar innovative activities.

The fund has delivered strong albeit volatile performance since inception in November 2017, generating an average annual compounded rate of return of about 13%, compared with 10.7% for the Nasdaq Composite Index. In the first two months of 2019, the fund has returned a lights-out 22.1% compared with 9.7% for the index.

Much of this outperformance can be attributed to the fund’s active, opportunistic approach. Markets did not favour that approach last year, and the fund ranked in the 50% percentile of performance, with a nearly 30% peak-to-trough drawdown. While it has been recovering, such strong bouncebacks may not keep repeating in an environment where investors start rewarding earnings quality. So this fund remains a decent pick for investors with high risk tolerance who can be comfortable with volatility well above the index and peer group.

Despite its decent beginning, I’m concerned that the fund may struggle when we see market leadership rotate to value. For that reason, I’m reluctant to use this as a core holding, favouring it instead as part of a well-diversified portfolio. I see this fund pairing up nicely with a more value-focused offering such as Fidelity NorthStar Fund.

All Rights Reserved. © D.A. Paterson & Associates Inc. All Rights Reserved. Reproduction in whole or in part without written permission is prohibited. Financial Information provided by Fundata Canada Inc. © Fundata Canada Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. The foregoing is for general information purposes only and is the opinion of the writer. No guarantee of performance is made or implied. This information is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice.