Download a PDF Copy of this report

Markets gain in the merry month of May

But equity indices likely to remain rangebound as volatility becomes the new normal …

May started out nicely for equity investors as markets rallied higher on stronger corporate earnings and rising oil prices. Over the course of the month, the volatility that we had seen in February, March, and April seemed to settle down, with markets taking on a calmer tone. A calmer tone, that is, until the final few days of the month, as political uncertainty in Italy and Spain caught investors’ attention.

The main attraction was the inability of the Italians to form a government, which created worry and speculation that Italy may take a cue from the U.K. and leave the European Union with its own version of Brexit.

The yield on the Italian 2-year bond went from being negative in the early part of the month to trading as high as 2.75% on May 29. Such a violent move in rates sparked concern of a contagion that could spread across Europe, as bond markets around the world sold off heavily, and investors plowed into the safe haven of U.S. Treasuries.

This bout of high anxiety also saw a short selloff in the equity markets, but with strong gains earlier in the month, most equity markets finished in positive territory. Fortunately, in the first few days of June, calmer heads have prevailed, and sanity has returned to the markets.

Another headline was the escalation of President Trump’s trade war with the announcement that Canada, Mexico, and the European Union would no longer be exempted from tariffs on steel and aluminum. Canada, Mexico, and the EU acted swiftly, announcing retaliatory tariffs on a mixed bag of goods.

So far, equity markets have largely yawned at the tit-for-tat tariff wars, hoping a solution can be worked out.

For the month, the S&P/TSX Composite Index gained 3.1%, with healthcare and technology leading the way. The S&P 500 Composite Index rose by 2.4% in U.S. dollar terms, but thanks to a rise in the U.S. dollar, the return for unhedged Canadian investors was 3.6%. European and Asian markets ended mostly down on the back of increasing turmoil in the region.

Canadian bonds were mostly higher over the month, with government bonds outpacing corporates.

The U.S. Federal Reserve hiked its federal funds rate on June 13 by 25 basis points, and the Bank of Canada is likely to follow suit in coming months. Economic data continues to be strong, and concerns over inflation pressures are on the rise. This may create a further headwind for bonds.

In this environment I am keeping my allocation to fixed income underweight and maintaining a modest overweight to equities. I expect volatility to remain higher than it has been in the past couple of years, but barring something out of left field, I expect volatile, but modestly rangebound markets.

Please send your comments to feedback@paterson-associates.ca.

Special Feature: Natixis Tax Managed Funds

This month, I take a deeper look at the revised and revamped Natixis funds…

They say in life, there are two sure things: death and taxes. If there is one thing that Canadian governments are particularly astute at, it is raising taxes. This holds true whether you are talking about employment income or investment income.

In recent years, the federal government has taken many steps to reduce the ability of investors to reduce their taxes by making changes to corporate class mutual funds. Changes include eliminating the ability to use derivative or other instruments to change the tax characteristics of investment income, and the elimination of the ability to switch on a tax-deferred basis within mutual funds in the same corporate structure. In the most recent budget, Finance Minister Bill Morneau enacted changes that affect the tax treatment generated within a personal corporate structure. The result is the same, meaning higher taxes for investors.

Natixis Investment Management, a global investment manager, with offices in more than 30 offices around the world and nearly a trillion dollars in assets under management, has an innovative structure for Canadian investors to help lower taxes.

The process was created by the late Jim Hunter, the highly regarded mutual fund pioneer. Mr. Hunter was known for many innovations in the Canadian mutual fund business, including the creation of “clone funds,” and was behind the first income-conversion fund.

In 2005, Mr. Hunter left his position as chairman of Mackenzie Investments to launch NexGen Funds, which was acquired by Natixis in 2014. At NexGen, Mr. Hunter created a structure that allowed investors to choose the type of investment income they would like to receive, with the choices being regular income, dividends, capital gain, or return of capital. Within the corporate structure, there are four different tax classes: Registered; Return of Capital; Compound Growth; and Dividend.

All income earned by all the funds in the structure are pooled and then separated by tax treatment. The income that is taxed at the highest level is directed towards the Registered class. Examples include interest income and foreign income. Because the Registered class is designed to be held in a tax-deferred plan, the type of income and its tax rate is irrelevant, as investors do not pay any tax on income earned until it is removed from the plan upon withdrawal.

Dividend income is funneled to the Dividend class of units, and investors receive a fixed monthly distribution that is designed to be treated as eligible Canadian dividends.

The Compound Growth class is not expected to receive any distributions, and all gains will be treated as capital gains when sold.

The Return of Capital class will pay out a regular monthly distribution that will be treated as return of capital. A return of capital distribution is not taxed in the year it is received. Instead, it reduces the adjusted cost base of the investment, and any difference between the sale price and adjusted cost base will be treated as a capital gain when the investment is sold.

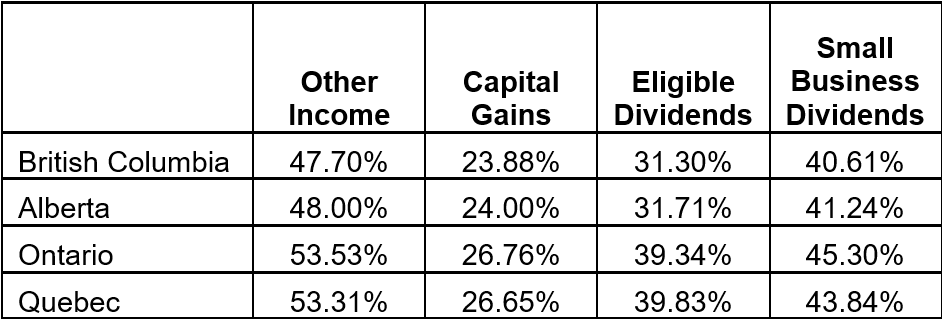

The difference in tax rates is not unimportant. For example, in 2017 the highest marginal tax rate for investment income in Ontario was 53.31% compared with 26.76% for capital gains. Clearly, for an investor, it is more beneficial to have more income in the form of capital gains than from regular income.

The table below highlights the combined tax rates for various types of income from a few provinces in Canada.

It really is an innovative approach, and so far, it has not been copied by any of its competitors. The main reason is that the firm has applied for a patent, which has not yet been approved. However, while the patent is pending, no one can copy the process. Whether or not the patent will be approved is still up for debate, and it is expected that if it is not awarded, competitors will step in to copy the structure. Until then, Natixis can try to benefit from its first-mover advantage

Before Natixis took over NexGen I really wasn’t really a fan of the funds, to be honest. The main reason was that in my opinion, the relatively poor investment quality of most of the NexGen funds did not make up for the better tax treatment. However, since the takeover, many new managers have been brought into the program, and the investment quality has improved substantially.

Under Natixis, high-quality managers like Harris Associates, Loomis Sayles, and Gateway are now available in this more favourable tax structure. This means that you don’t necessarily have to sacrifice investment quality for a more favourable tax treatment.

For investors looking to reduce their tax burden, it may be worth taking a look at Natixis.

.

Funds of Note

This month, Capital Group gives up DSC, and I look at funds from Beutel Goodman and Canoe…

Capital Group discontinues DSC purchase option

There was another nail in the coffin of the old-style deferred sales charge (DSC) as Los Angeles-based Capital Group announced it would be eliminating its DSC options starting on May 24. Capital is just the latest to make this move, following similar actions from Dynamic Funds and Investors Group.

A DSC fund pays the advisor a commission that is typically 5% at the time the investor makes a purchase. However, the investor is now on the hook to pay a redemption charge if they redeem within five to seven years. The redemption charge typically starts in the 5.5% range and declines every year until hitting zero.

In theory, if it’s a quality fund and the investor has a long time horizon, it is a win/win because the advisor is still paid for their advice, and the investor gets access to a great fund. In practice, it didn’t always work out that way because some advisors saw the DSC as an incentive to invest a client for the quick commission, while locking the client into a subpar fund or fund family. A DSC fund also limits the flexibility in managing a portfolio, because you are forced to stay within a fund company or pay a sometimes hefty fee to exit.

Another issue I have always had with DSC funds is that because the investor doesn’t see what they are paying the advisor, it creates the perception they are getting financial advice for free. In practice it is not free, and in the end, it really undervalues the perception of the value of financial advice. Most advisors work very hard for their clients and deserve to be compensated fairly for their efforts. However, hiding behind a DSC commission or even an embedded trailer fee really masks the true value a good advisor brings to the table.

I for one am happy to see that the DSC’s days are numbered.

Beutel Goodman Corporate Provincial Active Bond Fund (BTG 971 – No Load Units, BTG 112 – Fee Based Units

Beutel Goodman announced recently that it was making some changes to its Provincial Active Bond Fund. The fund is being renamed the Beutel Goodman Core Plus Bond Fund, and there are some modest changes being made to its investment mandate.

It now has more flexibility around credit quality. Until recently, the fund could invest only in investment-grade issues. Under the new rules, it can invest in bonds rated at least B at the time of purchase. The weighted-average credit quality must be at least BBB at all times.

The fund can now invest in non-Canadian dollar-denominated bonds up to a maximum of 30% of the portfolio. Foreign currency exposure is expected to be fully hedged, but the manager has the ability to run up to 20% unhedged, if they see an opportunity to tactically benefit. It can also invest in NHA-insured mortgages and mortgage-backed securities, as well as preferred shares, up to a maximum of 10%.

The exposure limits have also changed marginally, moving from a hard-coded limit to a benchmark-plus approach. For example, the maximum exposure to corporate bonds had been capped at 50%. But this has now changed to the benchmark plus 30%, which provides a bit more flexibility to the manager.

All things considered, I see this as a very positive development for the fund. It provides the manager with more management tools, which will become increasingly more important as the fixed-income environment continues to become more complicated.

The new global exposure combined with the ability to add mortgages and non-investment grade bonds would be expected to help reduce interest-rate sensitivity and increase the potential yield. While the changes are meaningful, I don’t expect them to result in a full-on change to the fund, but rather a modest evolution. Nevertheless, I am positive on the changes, and will continue to monitor the fund closely to ensure there is not a meaningful increase in the risk profile.

Canoe Global Income Fund (GOC 7001 – Front end Units, GOC 7002 – Low Load Units)

I highlighted this fund last November and except for May, it has pretty much lost money every month. In fact, from November 30 to May 31 the fund has lost 1.7%, while the peer group is down a little more than 1%. Let’s take a look at what happened.

The fund is an actively managed, “go anywhere” bond fund that invests around the world across the full credit spectrum, with a focus on investment grade bonds. It is managed using an investment process that blends top-down macro analysis with bottom-up security selection. Currently, it is positioned defensively with a duration that is much shorter than its benchmark. At the end of May, duration sat at approximately 3.5 years, compared with nearly 6.0 for the benchmark.

The fund is heavily tilted towards the U.S., which makes up more than 80% of the assets, with the rest mostly in Europe. Credit quality is high, with nearly two thirds in investment-grade issues. Despite this, performance has lagged.

Heading into the year, the managers believed credit was fully valued but that fundamentals and technicals remained very compelling. However, in February volatility returned to the equity markets, which saw government bonds outperform corporate bonds on a flight-to-safety trade. To the end of April, U.S. government bonds had fallen by 2.2%, while corporate bonds fell by nearly 3.5%. This created a lag for the fund compared with its benchmark and many of its peers that held a higher weight in government bonds.

Digging deeper into the performance, it was the shift in the yield curve that was responsible for most of its loss so far year to date, as bond yields have increased substantially so far in 2018. Also adding to the woes was the widening of credit spreads, as government bonds outperformed in volatile equity markets. The fund was able to hold up better than tis benchmark on both of these measures.

Further, the fund is offering a higher yield to maturity than its benchmark, which generated a higher coupon income and helped to mitigate some of the loss. In addition, it fully hedges its currency position, so it did not benefit from the stronger U.S. dollar.

Despite this disappointing performance, I still believe the fund is a strong global fixed income offering, at least on a risk-adjusted basis.

First, the outlook for bonds remains stable. The U.S. economy continues to be strong, and the impact of the tax cuts is being felt by U.S. companies, which is expected to help to narrow credit spreads. Next, the fund offers a higher yield to maturity and a lower interest-rate sensitivity than many of its peers, which is expected to help it in a volatile environment.

After the latest widening in credit spreads in the aftermath of the recent political turmoil in Italy, many corporate bonds are trading at very attractive levels. Strong growth is expected to help narrow these spreads over time. The fund has a healthy exposure to high yield and floating rate notes, which are expected to help enhance return while reducing duration.

I expect the fund to continue to deliver stable, consistent risk-adjusted returns for investors. I don’t expect it to be the best-performing fund on an absolute basis, but when you factor in the low or modest volatility, I expect it to be near the top on a risk-adjusted basis over the long-term.

If there is a fund that you would like reviewed, please email a request to me at feedback@paterson-associates.ca

June’s Top Funds

Mackenzie Floating Rate Income Fund

| Fund Company | Mackenzie Investments |

|---|---|

| Fund Type | Floating Rate Loans |

| Rating | A |

| Style | Bottom-up Credit Analysis |

| Risk Level | Low – Medium |

| Load Status | Optional |

| RRSP/RRIF Suitability | Good |

| Manager | Steve Locke since June 2013 |

| Felix Wong since June 2013 | |

| MER | 1.76% - Front-End Units |

| 2.00% - Low-Load Units | |

| Fund Code | MFC 4336 – Front-End Units |

| MFC 7210 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: This fund invests in a diversified portfolio of floating-rate loans and notes. These are usually loans issued by companies whose payout fluctuates with the prevailing rate of interest in the economy. The rate paid is typically based on a well-known benchmark rate such as LIBOR.

These types of investments are attractive to investors because the fluctuating interest rate reduces the amount of rate sensitivity in the portfolio, which is reflected in the fund’s low duration of less than half a year, compared with 7.5 years for more traditional bonds. And at 7.5% the higher yield to maturity also compares favourably with the 2.75% for the broader Canadian bond market.

Of course, the risk is higher too, as the fund focuses on high-yield holdings with only 6% classified as investment-grade. This means the risk of default is significantly higher than with a traditional bond fund.

Another risk is that these loans tend to be less liquid than other fixed-income investments. This may make it more difficult for the manager to sell out of positions if there is a run on redemptions.

Managed by long-time fixed-income veteran Steve Locke and his team, the fund uses a mix of top-down macro analysis combined with bottom-up credit analysis, focusing on loans where they believe they are being well compensated for the risk.

Performance has been strong, with a 5-year average annual compounded rate of return of 4.6% to May 31, handily outpacing its peers. The fund has an edge in its more active style, allowing the manager to trade more frequently and take profits in loans that have performed well. This is still possible given the fund’s current size. But if assets grow significantly, liquidity may begin to hinder the more frequent trading.

A potential drawback is that the fund has been more volatile than many of its peers. But to date, this higher volatility has been more than offset with additional return. While I like floating-rate funds as a way to generate higher income and reduce interest-rate sensitivity, I don’t believe them to be appropriate as a core holding. Instead, they are a great addition to an otherwise well diversified portfolio. For those looking for floating rate exposure, this is certainly a fund worth considering.

.

Fidelity Dividend Fund

| Fund Company | Fidelity Investments Canada |

|---|---|

| Fund Type | Cdn Dividend & Equity Income |

| Rating | B |

| Style | Large Cap Value |

| Risk Level | Medium |

| Load Status | Optional |

| RRSP/RRIF Suitability | Excellent |

| Managers | Geoff Stein since April 2011 |

| David Wolf since March 2014 | |

| MER | 2.10% Front-End Units |

| 2.30% Low-Load Units | |

| Fund Code | FID 221 – Front-End Units |

| FID 341 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: Performance in many dividend strategies has suffered in the past year or two as investors worry over rising rates and chase high-flying growth stories. Still, over the long-term, dividends play an important role in returns, accounting for nearly 77% of the total return of the S&P/TSX Composite for the 10 years ending May 31.

One of my favourite dividend funds is this Fidelity offering helmed by lead managers Geoff Stein and David Wolf. It is set up like a “fund of funds,” with sub-managers Don Newman running the dividend equity sleeve and Catriona Martin and Sri Tella looking after the fixed-income side. The neutral mix of the fund is 95% equities and 5% bonds. The asset mix is fairly static.

Equities are managed using a fundamental, bottom-up “growth at a reasonable price” approach, as managers seek out companies that trade at a reasonable price and have the potential to not only maintain, but also grow, their dividends. Common characteristics include strong free cash flow generation and improving earnings power. Quality of management is also considered. The fund’s sector mix looks has heavy exposure to financials, REITs, telecos, and utilities.

The fixed-income sleeve has a core-focused approach that blends top-down macro analysis with bottom-up security selection.

Performance over the past year has lagged, with a 12-month return of 0.5% to May 31, compared with 7.8% for the index. One reason for the underperformance is the high cash balance, which at April 30 sat at a 27% weighting.

Value and interest-sensitive names have lagged, and market valuations remain high, resulting in a more conservative positioning for the fund. The high cash weight has been a drag on performance but will buffer the fund against volatility and provide trading flexibility when valuations become more reasonable.

The fund tends to be less volatile than the index or its peers, resulting in better-than-average risk adjusted returns over the long term. Despite its recent troubles, the fund remains a solid offering in the Canadian dividend space.

.

Meritas International Equity Fund

| Fund Company | OceanRock Investments Inc. |

|---|---|

| Fund Type | International Equity |

| Rating | C |

| Style | Large Cap Growth |

| Risk Level | Medium |

| Load Status | Optional |

| RRSP/RRIF Suitability | Good |

| Manager | Alliance Bernstein since Mar. 01 |

| MER | 2.96% |

| Fund Code | SRI 005 – Front-End Units |

| SRI 505 – Low-Load Units | |

| Minimum Investment | $500 |

Analysis: One of the leaders in the Responsible Investing (RI) space is Vancouver-based OceanRock Investments, which offers the Meritas lineup of standalone funds and managed portfolio solutions. This international equity offering is one of their more attractive funds.

RI adds a company’s environmental, social, and governance (ESG) policies to the decision process. The fund is managed by AllianceBernstein, a respected global investment firm, using a disciplined, bottom-up approach that blends fundamental and quantitative analysis to identify well-managed, high-quality companies that are trading at what they believe to be an attractive level of valuation.

In addition to the traditional investment analysis, the fund has incorporated ESG factors into the analysis. There are three distinct cores to the process:

Screening uses a mix of negative and positive screens to identify potential companies. Negative screens include such things as tobacco, alcohol, or military. Positive screens look for strong labour standards, positive environmental impact, and gender and cultural equality policies.

Shareholder engagement is an activist strategy that involves shareholders pressuring management for positive changes.

Impact investments are opportunities that can have a positive effect on the environment, communities, and society.

Despite the perception that ESG funds underperform, this one has more than held its own, with a 5-year average annual compounded rate of return of 11.2% to May 31. It trails the index, but slightly outperforms its broader global equity peer group. Volatility has been below average, which has resulted in above-average risk-adjusted returns over a 3-, 5-, and 10-year periods. It has also done a solid job protecting capital in down markets, on average outperforming the index when it falls.

The main drawback to this fund is its cost. The full-freight advisor-sold units carry an MER of 2.96%, well above the peer group. While not my first pick in the international equity space, it is my top pick for those looking for a solid ESG Fund. Strong management combined with a disciplined process and a focus on quality make this a solid choice.

.

Mawer Global Small Cap Fund

| Fund Company | Mawer Investment Management |

|---|---|

| Fund Type | Global Small Mid Cap Equity |

| Rating | B |

| Style | Small Cap Blend |

| Risk Level | Medium |

| Load Status | No Load |

| RRSP/RRIF Suitability | Excellent |

| Manager | Christian Deckart since July 2015 |

| Paul Moroz since October 2007 | |

| MER | 1.76% |

| Fund Code | MAW 150 |

| Minimum Investment | $5,000 |

Analysis: The fund marked its 10-year anniversary last October having consistently delivered excellent returns on both and absolute and risk-adjusted basis. Its 10-year average annual compounded rate of return to May 31 was 14.8%, nearly double the category average and markedly over the 11.5% posted by MSCI World Small Cap Index. Perhaps more impressive is the consistency of performance. Since its launch, the fund has trailed its peers in only two years, 2010 and 2016. A key to this is the fund’s downside protection, outperforming the index in falling markets.

To achieve this, managers Paul Moroz and Christian Deckart, who was promoted to lead manager in January 2018, use a highly disciplined, research-focused, bottom-up investment process looking for companies with strong business models that earn a high return on capital arising from a sustainable competitive advantage.

They also spend a great deal of time focusing on the company’s management. Once they have identified a potential investment candidate, they build out and stress-test financial models under a number of different scenarios.

The managers are also careful to ensure they are buying a company at a level that is well below their estimate of its true worth. Their approach is a patient one, and when they buy a stock, they expect to hold it for 10 years or longer. In reality, the average holding period comes in at around 6 to 8 years.

The portfolio is rather diversified at 70 names, with the top 10 representing about a third of the assets. Country and sector weights are the result of the bottom-up stock selection process. And at the end of May, the fund was defensively positioned with roughly 9% in cash.

Sectorally, the fund is positioned for growth, with an overweight in technology, industrials, and consumer defensives. It has no exposure to utilities or telecoms, and very little in real estate, which reduces its interest rate sensitivity.

Geographically, the fund has its largest weightings to the U.K. and Europe and very little exposure to North America.

The fund continues to be an excellent pick for those looking for global small cap exposure. Given the potential risks, I don’t see this as a core holding. Instead, it can be a great addition to an otherwise well-diversified portfolio.

All Rights Reserved. Reproduction in whole or in part without written permission is prohibited. Financial Information provided by Fundata Canada Inc. © Fundata Canada Inc. All Rights Reserved. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. The foregoing is for general information purposes only and is the opinion of the writer. No guarantee of performance is made or implied. This information is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice.