Volume 18, Number 6

June, 2012 Single Issue $15.00

In this issue:

- What’s New

- Steadyhand Turns Five

- ETF Recommended List Review

- Couch Potato Portfolio Posts Modest Gains

- Protect Your Portfolio With Dollar Cost Averaging

- Sell In May And Go Away

What’s New

- Correction – On page 5 of the May 2012 edition of the Mutual Funds / ETFs Update there was an error on the Recommended List of Funds table. The heading of the third column was labeled “Results (to Dec 31)”. It should have read “Results (to Mar 31)”. The return data in the table was the correct data for the three months ended March 31, 2012. We do apologize for this error and any inconvenience that it may have caused.

- Active managers outperform in first quarter – The first quarter of 2012 was a positive one for active managers, with more than 66% of large cap Canadian equity managers beating the S&P/TSX Composite, based on the latest Russell Active Manager Report. The quarterly report that was released on May 2 analyzes the returns of 140 Canadian equity money manager products. According to the study, the environment for active managers has been favourable for some time, with more than 76% outperforming in the final quarter of 2011. The median large cap manager return was 5.3% compared to the S&P/TSX Composite’s return of 4.4%.The level of outperformance was even more pronounced depending on style. Value managers were by far the winners, with over 90% outpacing the index. Growth managers didn’t fare as well, with only 41% beating the benchmark. Most of the difference in outperformance is attributable to their respective exposure to gold companies, with value managers having much less exposure to the sector. Small Cap managers were also relatively strong with more than 78% beating their index. This is up from 69% in the fourth quarter. The medium return for small caps was 8.0% compared to the S&P/TSX Small Cap Index which gained 6.0% in the quarter. Obviously, one quarter does not make a trend, nor does it prove active management is better than passive management. This does reinforce what we have been saying which is that in periods of volatility and uncertainty, the markets will have a tendency to reward strong company fundamentals, rather than focusing on the macro issues. Given our expectation for elevated levels of volatility, we continue to favour active managed funds over passive funds for the near to medium term.

- Investors Group cuts management fees – Investors Group, one of Canada’s largest mutual fund companies announced that management fees would be cut on about two-thirds of their fund lineup. The reductions will range from 0.05% to 0.40% and are expected to be effective in July, when the company renews its prospectus. These changes are subject to regulatory approval. Company officials have said that the move was made to help make their products more competitive with other funds. This is a step in the right direction, but they still have a way to go. For example, the company’s largest fund, the Investors Canadian Dividend Fund, carries an MER of 2.91%. According to Morningstar, the median Canadian Dividend & Income Equity Fund had an MER of 2.16% and the median Canadian Equity Fund was 2.33%. The Investors Canadian Bond Fund has an MER of 1.82% compared with the median Canadian Fixed Income fund’s MER of 1.49%. Cutting 40 basis points will help make the funds a bit more competitive, but they will still likely remain in the upper half of the category. Factor in less than stellar performance and we still believe that there are much better fund options available to investors outside of the Investors Group family. Our hope is that this move may have a trickledown effect on some of the other higher cost providers in the country and help to push costs down for investors. That said, we’re not holding our breath.

- Dynamic Introduces Fixed Administration Fees – In keeping with the theme of mutual fund costs, Dynamic Funds introduced the implementation of fixed administration fees to their funds. Under the proposed arrangement, the funds’ manager GCIC will pay the operating costs and expenses of the funds, and in return will receive a fixed administration fee that will range between 0.12% and 0.35% depending on the type of fund. Understandably, the fixed administration fee will be lower for fixed income funds and higher for global focused, and specialty funds. The idea behind these types of fee arrangements is that it provides investors with some level of predictability to the cost of a fund, since it is possible that operating costs may fluctuate from one year to another. The biggest drawback to such an arrangement is that the fee is fixed, and may not change based on the total assets of a fund, whereas under the operating cost methodology, larger firms may be able to achieve some economies of scale as assets under management grew. Realistically, the net impact to investors is expected to be negligible in the near to medium term.

- CI Manager lands at Sentry – Longtime Signature Canadian Bond manager James Dutkiewicz resigned from CI’s Signature Global Advisors and has joined fast rising income powerhouse Sentry Investments. While this is a loss to CI, the Signature team has the bench strength to make this a relatively easy transition on the funds. For Sentry, we view this as a positive as they get a recognizable bond manager to take the reins of their fixed income focused products. Further, given his time at Signature, with their emphasis on analyzing the full capital structure of a company, Mr. Dutkiewicz may be a valuable addition to the relatively small Sentry team.

STEADYHAND TURNS FIVE

By Dave Paterson, CFA

Client focused firm working to make clients better investors.

After having worked in the investment industry since 1994, I have developed a healthy sense of skepticism and cynicism which prevents me from getting too impressed when a fund company celebrates an anniversary or reaches a milestone. That said I have to admit that seeing Vancouver based Steadyhand celebrate their fifth birthday recently does make me happy to see it.

In hindsight, the company which was co-founded by the former CEO of Phillips, Hager & North Ltd. Tom Bradley, could not have been launched at a more inopportune time. Global equity markets were in the midst of a massive bull run that started in 2002, and some concern over its health were beginning to emerge. Little did we know at the time that those concerns would result in such massive selloffs in the global equity markets, which saw most developed markets drop more than 40% between late 2007 and early 2009.

Since then we have lived through the U.S. subprime mortgage fiasco, the global credit crisis, the collapse of the U.S. housing market, a global recession and more recently the European debt crisis. Yet through all of this, Steadyhand has managed to grow to more than $175 million in assets under management in its five core funds. “Are we as big as we thought we’d be at year five with $175 million and 1200 clients?” asks Mr. Bradley rhetorically. “The answer is no. But client satisfaction, first quartile performance, momentum and inflows tell us that while this has taken us longer than we thought, it is coming. It’s been a ridiculous time to build a business from scratch, but it’s been a great time to prove who we are and what we do,” said Mr. Bradley.

According to Mr. Bradley, “The markets and market sentiment were on a roller coaster. But if you transpose Steadyhand on that, I have to tell you, we have been just a picture of calmness and stability, which is what our name implies. During the 2008 and 2009 period, we kept people invested and got them buying. When things turned around and they got euphoric, we cooled them off, urging them to rebalance. You have this ridiculous up and down in the market, yet we’ve lived up to our name and have been pretty calm.”

Apart from not having as many client assets as they would like, another disappointment for the firm has been with their investment performance during 2008. “I thought our philosophy would stand up better than it did. But when we look at our five year numbers, our balanced clients are solidly first quartile,” said Mr. Bradley.

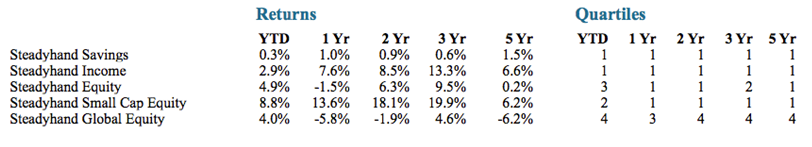

There have also been many positives along the way including the performance of the funds. As of April 30, all the funds have finished in the first quartile, outpacing the vast majority of their respective peer groups. The lone exception to this is the firm’s global equity offering, which has been one of the sore spots for investors.

The Steadyhand Global Equity Fund (SIF 140) is managed by Edinburgh Partners using a go anywhere mandate. It, like the other Steadyhand funds is a concentrated portfolio, holding approximately 40 stocks. Despite the underperformance, the firm is sticking with them. “Their long term track record is still great” says Mr. Bradley. “They are a firm that is not afraid to follow their valuation nose and act on their convictions which is a theme that is not only found in our hiring of managers, but with our ongoing relationships with them. We are very patient. Our meetings aren’t to beat them up over RIM or Manulife or Nokia. It’s to probe and understand the process around that. There might be some on my team who are mad that I don’t beat the managers up more, but when a manager is down, that’s when you need to support them. They don’t need to be beaten up more. They’ve already been beaten up. But we do want to understand why those mistakes happen.”

One of our favourites in their lineup has been the Steadyhand Income Fund (SIF 120) which is as close as they have to a bond fund. Mr. Bradley calls this his “bond beater” which is what it is designed to do over the long term, with a target weighting of 75% bonds and 25% income focused equities such as REITs, high yielding common shares, and preferred shares. There will obviously be periods of time where this doesn’t happen, with 2008 being a prime example. That year, the fund dropped by nearly 9%, yet the DEX rose by 6.4%. This can be attributed to the fund’s high weightings in corporate bonds and its equity exposure.

While this positioning has hurt the fund compared to the DEX Universe in the past, we expect that it will be an asset going forward. In speaking with many bond managers of late, given the lack of solid growth in the global economy, they don’t expect interest rates move sharply higher in the near term. Many have stated that they believe a reasonable expected return for bonds would be the coupon rate of the bond, less any fees. Many are forecasting that equities will perform better than fixed income over the medium term. If that base case does come to fruition, this fund, with its larger exposure to higher yielding corporate bonds and 25% equity exposure should outperform a traditional bond fund over the medium to long term. Factor in a low MER and you have a winner.

Another one of our favourites is the Steadyhand Small Cap Equity Fund (SIF 150) which is managed by Wil Wutherich who is based in Montreal. According to Mr. Bradley, Mr. Wutherich “is a unique cat. He is very disciplined. He doesn’t care about the index at all. He is just looking for what he calls ‘diamonds in the ditch’ which are companies that have a history of earnings and cash flow and in the small cap sense are a little bit more mature.”

Because of this emphasis on earnings and cash flow, the fund is underweight in resources, particularly materials, which will result in it lagging the markets when resources are hot. 2009 is a prime example when the BMO Canadian Small Cap Index rose by nearly 70% while the Steadyhand Small Cap Fund was up by only 15%. Another byproduct of the focus on more mature companies is that the fund’s volatility will likely be lower than many other funds in the category.

The Steadyhand Equity Fund (SIF 130) is a Canadian focused equity fund managed by Toronto based CGOV Asset Management. Mr. Bradley describes the fund as “a clean, tight, high conviction portfolio.” It is Canada centric, but CGOV can invest up to 49% of the fund outside of our borders. “The basic premise is that I want great Canada exposure, but I didn’t want to limit them,” says Mr. Bradley. He goes on, “I just didn’t want to have a manager have to be bound by this distorted, funny, illiquid market we have here with the three big sectors,” of course referring to materials, energy and financials. In describing the fund Mr. Bradley says, “It’s a neat little fund. It has some of the perfunctory Canadian stocks. It’s got TD Bank, Suncor Energy, Crescent Point Energy, but it also has Compass Minerals International, Asia Pacific Brewery and Novartis.” Companies that you wouldn’t normally expect to see in a Canadian focused equity fund.

Performance has been above its peer group except for 2009 where it lagged the index. Mr. Bradley also points to 2010 “where high quality companies with no need for financing or bank renewals weren’t doing so well, but it’s really served them well the past couple of years.”

There is also the Steadyhand Savings Fund (SIF 110) which is the firm’s money market offering. It’s a great place to hold cash if you want to keep it within your Steadyhand account as “dry powder”. The reality is that you can do better elsewhere if you’re looking for just a money market or high interest savings account.

The company recently added a fund of fund solution aptly named the Steadyhand Founders Fund (SIF 125), which is managed by the firm’s co-founder Tom Bradley. Until now the company resisted offering a balanced fund because they “wanted to build every portfolio to be very customized based on the client,” said Mr. Bradley. He goes on, “the reality is that a lot of client portfolios are 60/40 or 50/50 or something similar.” Another trend the company noticed when reviewing client accounts was that only a small portion of the client base was actually managing their portfolios by doing such things as basic rebalancing. The Founders Fund will help address these issues as Mr. Bradley will actively manage the asset mix of the fund looking to take advantage of trends as they develop, and take care of the day to day portfolio management duties such as rebalancing. It made its debut in February and has already attracted $15 million in assets. Mr. Bradley doesn’t think it unreasonable to see this fund continue to grow to become one-third to even half of its total assets as many clients “have busy lives and aren’t as engaged and trust us to do the things for them.”

Looking Ahead

Steadyhand has made admirable progress in the past five years, particularly in the face of the market environment and global economic uncertainty. When asked about what the future holds for the firm, Mr. Bradley said, “We definitely need to grow further. We have a real business here, but we need to get to $250 million or more.” To help get there, the company is investing heavily in technology that will allow them to realize that growth without increasing costs to investors.

They will also keep doing “more of the same.” They will continue to invest client funds using the philosophy of “undexing” and not “putting handcuffs” on their portfolio managers. By creating high conviction, concentrated portfolios, the investment talent has a chance to outpace the indices. Says Mr. Bradley “If I want index returns, I’ll buy an ETF.”

Director of Business Development David Toynes summed it up nicely with, “We wake up every day with a real sense of purpose to change the landscape and to re-tilt the tables in favour of the investor.” The company has vowed to continue to focus on doing what’s right for the investor by offering low fees, unbiased advice and open, honest and transparent communication with investors.

Bottom Line

Operationally and philosophically, Steadyhand is well aligned with its investors. From an investment standpoint, they offer a concentrated lineup of funds from which an investor can build a strong portfolio. Their strengths are the Steadyhand Income Fund and the Steadyhand Small Cap Fund, with the Global Equity Fund being the biggest weakness in the lineup. For do it yourself investors who are looking for actively managed mutual funds and a company that will provide some investment guidance along the way, Steadyhand is a great place to start. For those looking to be more hands on and create a broader portfolio, we would suggest they focus on the firm’s Income and Small Cap Equity offerings and rounding out your global and Canadian equity exposure elsewhere.

ETF RECOMMENDED LIST REVIEW

By Dave Paterson, CFA

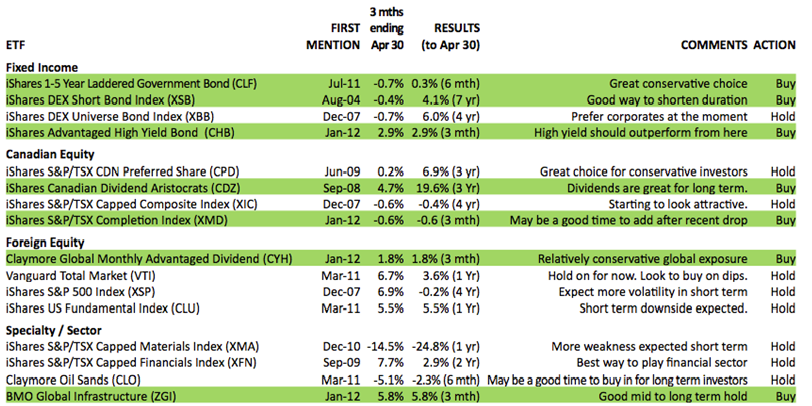

With volatility returning to the markets, caution is warranted with a renewed focus on quality.

As we entered into 2012, our expectation was that markets would remain volatile for a number of reasons including the ongoing uncertainty coming out of Europe, worries over the health of the U.S. economy and concerns of an economic slowdown in China and other emerging markets. During the first quarter, many, including ourselves, were caught off guard as volatility was virtually nonexistent. Investors put the European debt crisis on the backburner and instead focused on the signs of improvement that were coming out of the U.S. This resulted in strong gains in global equity markets and bond markets were largely down.

Then, almost at the stroke of midnight on the first day of April, things changed and volatility reemerged with a vengeance. In the first quarter there were some positive steps towards controlling the European debt crisis. In the first days of April, it all began to unwind, first with a ratings downgrade on Spanish bonds and then uncertainty caused by election results in a number of countries, most notably France where Francois Hollande, an anti austerity candidate won over Nicolas Sarkozy, and in Greece, where the parties were unable to form a coalition government. This did not sit well with investors who quickly sold off equities and returned to the safe haven of government bonds.

There were also signs that China, which has been a key driver of commodity prices, is experiencing a more severe slowdown than previously expected. This will likely result in continued weakness in commodity prices as demand continues to slow.

We expect that this volatility will remain in place for the foreseeable future. It is our view that investors should continue to be relatively defensive. For those with a medium to long term time horizon, we are favouring high quality, dividend paying large caps over more cyclical small cap names. However, for those with a higher risk tolerance, there may be some short term opportunities in the small and mid cap space after their recent pullback.

From a country perspective, we prefer the U.S. over Canada. Much of the Canadian growth story will be dependent not only on the U.S., but also China and how the economic recovery unfolds in those two countries. Europe is currently in the throes of a recession and we expect high levels of uncertainty and volatility to remain firmly entrenched for the next several quarters.

For fixed income investments, it is our expectation that the days of high single digit returns are gone. We are now expecting fixed income to be modestly positive. We are no longer looking to fixed income investments to be a major source of investment returns over the medium term, but instead are looking for fixed income to act as a volatility buffer in periods of uncertainty. For the safe haven appeal, we like high quality government and corporate bonds.

Interest rates are expected to move higher, but likely not until next year. That said, we do favour a shorter duration over a longer duration in the near to medium term as a way to help protect invested capital. For those with a higher appetite for risk, there may be some opportunities to generate modest returns within the high yield space.

During the quarter, we did not make any additions or deletions in our ETF Recommended List.

Ratings Changes

iShares Canadian Dividends Aristocrats Index (CDZ) – This recently renamed offering was formerly known as the Claymore S&P/TSX Canadian Dividend ETF. It is designed to replicate the S&P/TSX Canadian Dividends Aristocrats Index which includes only those stocks with a market capitalization that is over $300 million, and which have increased their dividends for at least five consecutive years. The portfolio is currently made up of about 60 names. Performance has been strong, outpacing not only the broader S&P/TSX Composite Index, but also the majority of its peer group. We see this as a great way to access high quality, large cap dividend paying stocks, which we believe will outperform over the long term. We upgraded this ETF from HOLD to BUY.

COUCH POTATO PORTFOLIO POSTS MODEST GAINS

By Dave Paterson, CFA

Performance continues to improve but still lags more active strategies.

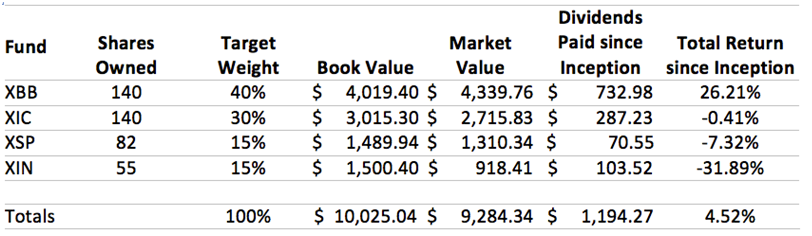

Our couch potato portfolio posted a modest 0.33% gain in the three month period ending April 30. Since its January 2008 launch, the portfolio has risen by a mere 1.03% per year on an annualized compounded basis, or a total return of 4.52%.

It was once again the iShares S&P 500 Index Fund (CAD Hedged) (TSX: XSP) leading the way higher, rising by more than 6.5% during the period on improving economic news out of the U.S. Despite losing nearly 3% in the month of April as investor focus returned to the European debt crisis, the iShares MSCI EAFE Index Fund (CAD Hedged) (TSX: XIN) gained nearly 2.6% during the quarter.

Canadian equities were lower as fears of a slowdown in China sent materials and energy stocks lower, dragging down the broader iShares S&P/TSX Capped Composite Index Fund (TSX: XIC) by 0.6%. During February and March, market volatility was virtually nonexistent, pushing bond yields up and prices down. As a result, the iShares DEX Universe Bond Index Fund (TSX: XBB) dropped by 1.14% for the three month period.

As we have stated in previous newsletters, we like the conceptual appeal of the couch potato portfolio. It is simple to understand and easy to put into action. We believe that it may be a good solution for those investors who have a long term time horizon and want to be able to set up their portfolio and forget about it until many years down the road.

But because of its simplicity, there may also be extended periods of time where the couch potato style of investing may lag an approach that is much more hands on. We believe that we are currently in one of those periods. We are experiencing periods of extreme market volatility and while things appear to have settled down slightly, there are still many headwinds and issues that remain unresolved.

In this uncertain environment, it is our view that investors would be better suited in a more active strategy, either by making tactical shifts within their portfolios themselves or by investing in high quality, actively managed funds. For example, if we look at the performance of the Couch Potato Portfolio in the most recent period, its return was a gain of 0.33%. In comparison, the average Canadian neutral balanced fund gained 0.7% and the average global neutral balanced fund was up by 1.4%.

Here is the latest report on the couch potato portfolio performance. Results are based on the prices as of April 30, 2012.

PROTECT YOUR PORTFOLIO WITH DOLLAR COST AVERAGING

By Dave Paterson, CFA

A great way to protect your lump sum investment from the risk of falling markets.

With volatility and uncertainty returning to the markets, one of the most common questions I am asked is “Is now a good time to invest?” My answer is always the same: “It depends.” If markets go up, then yes, it was a good time to invest, but if they go down, then no it wasn’t.

The unfortunate reality is that none of us have a crystal ball to predict the future. I spend a great deal of time analyzing market trends and economic numbers and I have an understanding of what should happen, but in uncertain times like now, what should happen isn’t always what does happen.

For investors in this environment, particularly those with a large sum, deciding when to invest can become a gut wrenching decision. On one hand, they wish to get their capital working for them in the markets, while at the same time, they don’t want to see it sink in value because of a sharp decline days or weeks after they put it in the markets.

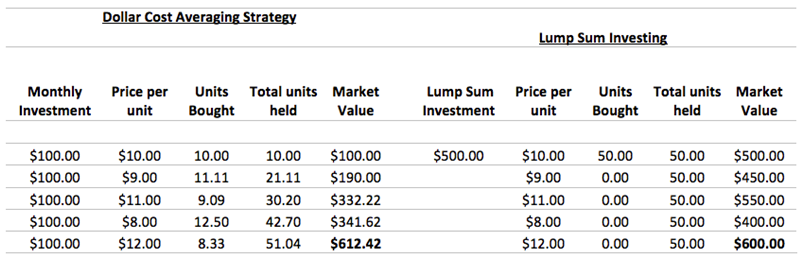

One strategy that investors use to help alleviate this stress is known as Dollar Cost Averaging (DCA). With DCA, the lump sum is gradually invested into the markets over a time, usually 12 to 24 months, but investors can choose any time period they wish. The rationale is that by investing the money gradually, the risk of loss from a big market decline is lowered. Critics point out that DCA is nothing more than a marketing gimmick and is not a sound investment strategy.

We should emphasize that when we are speaking about DCA in this context, we are not talking about a regular contribution plan like payroll deduction or regular monthly contributions an RRSP. Rather, we are discussing the potential benefits and pitfalls of investing a lump sum at once or over a number of months in periods of heightened volatility. We are firm believers in making regular contributions to your investment plan and believe not so much in the idea of timing the market, but time in the market.

How does it work?

A dollar cost averaging strategy is fairly simple to implement. Once you know how much you want to commit to the strategy and over what period, you begin investing that set amount on a regular basis, usually monthly or quarterly, until it is fully invested.

The table below shows a fairly simple example of a DCA strategy versus a lump sum investing strategy.

In this very simple example, at the end of the five month period, the DCA strategy would have allowed the investor to buy more units of the fund with their $500 investment when compared to the lump sum investing strategy. Over the long term, this should result in a better return.

This pattern will hold up in markets that are falling or are experiencing elevated volatility. However, in a rising market environment, the strategy would result in the DCA investor holding fewer units than units than the lump sum investor. This is because as the price per unit is rising, each regular contribution buys fewer units over time.

Does it work?

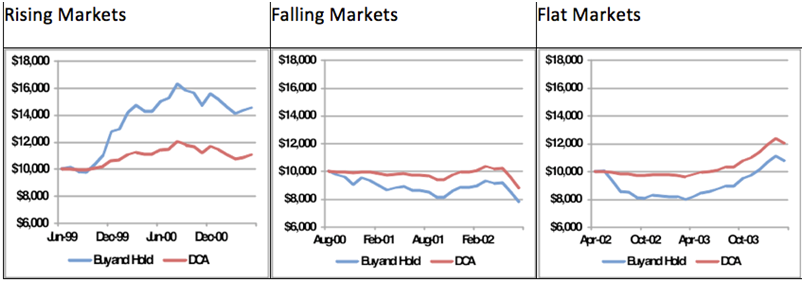

To further illustrate the strategy, let’s take a look at a how it would have performed over a few different time frames in recent history. For this example, we will be examining two $10,000 amounts in the Fidelity Canadian Growth Fund over a two year period. In the first, the entire amount will be invested in one lump sum, while with the other it will be invested equally over the 24 months. We will look at three different time periods; where the markets rose over the two years, where they fell, and where they were largely flat.

In these three examples, the DCA strategy appears to be the winner in falling and flat markets. Instinctively this makes sense because in falling markets, the DCA strategy will have a higher cash balance to protect against market declines. In a rising market, it also makes sense that the DCA strategy would be the laggard because the higher cash balance, particularly in the early days of the strategy will act as a drag on performance in rising markets. Further, as prices rise, each contribution will buy fewer units.

Proponents of DCA claim that it is a great way to invest in markets since it helps to take market timing out of the equation. That’s not an entirely accurate statement. With DCA, your capital is gradually invested over a number of months so if there are big gains early on in the program, your returns will lag than if you had made a lump sum investment. Conversely, if there are big losses later on in the program, your returns will not be as protected as more of your capital is invested in the markets.

Bottom Line

While dollar cost averaging may appear to be a low risk way to get your money working for you in volatile times, the reality is that it is a strategy that is not without its risks. How quickly your capital is deployed as well as the magnitude, direction and timing of any market movements will all have a significant impact on the effectiveness of your DCA program.

For investors who have a very long term time horizon (10+ years) and are looking for capital growth may wish to forego DCA and instead invest in a lump sum. However, for those investors who are more focused on protecting the downside and aren’t as concerned with the growth of their investment, DCA may be a good way to help protect their investment and get their money working for them.

SELL IN MAY AND GO AWAY

By Dave Paterson, CFA

Dont book the summer off at the cottage just yet!!

We have all probably heard the old investment adage that tells investors to sell in May and go away. The theory is that if an investor sells all of their equity holdings in May and buys them back in the fall, they will make more money than if they held them all year round.

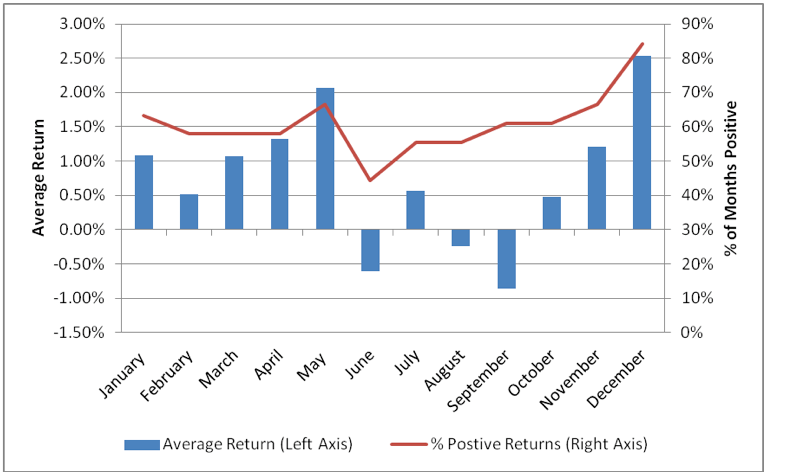

There is some evidence that this has worked on a historic basis. Using data from Fundata, we looked at the returns for the S&P/TSX Composite Index going back to December 1993. With this data, we see that returns have generally been positive between November and May, with June through October historically being the toughest months, both with returns and the number of positive months.

Let me state for the record that I do not in any way endorse this, or any other strategy that attempts to time the market. While this may work some of the time, it is not infallible, and if improperly used, can cause serious harm to your portfolio. The best advice is to build a well diversified portfolio that is in line with your investment objectives and risk tolerance and rebalance accordingly.

Experts including BMO Harris Private Bank and J. Zechner and Associates point out that there are a number of factors which make this summer a particularly perilous one in which to try to employ this investment strategy.

1.) China – While economic growth in China is expected to slow, it is still expected to be largely positive. BMO Harris Private Bank expects that China’s GDP growth will be 7.5% by the end of the year. While this may be down from their earlier frenetic pace, it is still much stronger than most of the other economies in the world and will provide a strong backdrop for growth, particularly in Canada.

2.) Corporate Profitability – Companies have continued to show impressive resilience when it comes to their bottom line. Corporate profitability remains strong and while input costs have been rising, many companies have invested in technology and made improvements to productivity which will help keep profit margins healthy.

3.) Credit conditions in the Eurozone: BMO Harris expects that the risks posed by the sovereign debt crisis will diminish and are not expected to have a material impact on the North American markets over the long term.

4.) The U.S. presidential election and the pace of economic recovery – BMO Harris is forecasting periods of economic distraction in the coming months as debt, budgetary issues, the end of quantitative easing, and the presidential election will cause a distraction from the basic fundamentals.

Bottom Line – While there may be some historic evidence that such a strategy has worked over the long term, there is no guarantee that it will continue to work in the future. Factor in significant levels of volatility and those who are not invested could risk losing out on a big rally. As always, our advice is to focus on a well diversified portfolio that is suitable for your risk tolerance and investment objectives.

Mutual Funds / ETFs Update

Editor and Publisher: Dave Paterson

Circulation Director: Kim Pape-Green

Customer Service: Katya Schmied, Terri Hooper

Gordon Papes Mutual Funds / ETFs Update is published monthly.

Copyright 2012 by Gordon Pape Enterprises Ltd. and Paterson & Associates

All rights reserved. Reproduction in whole or in part without written permission is prohibited. All recommendations are based on information that is believed to be reliable. However, results are not guaranteed and the publishers and distributors of Mutual Funds Update assume no liability whatsoever for any material losses that may occur. Readers are advised to consult a professional financial advisor before making any investment decisions. Contributors to the MFU and/or their companies or members of their families may hold and trade positions in securities mentioned in this newsletter. No compensation for recommending particular securities or financial advisors is solicited or accepted.

Mail edition: $139.95 a year plus applicable taxes. Add $30.00 for delivery outside Canada.

Electronic edition: $69.95 a year plus applicable taxes.

Single copies: $15.00 plus applicable taxes.

Reprint permissions: Contact customer service (416) 693-8526 or 1-888-287-8229

Change of address: Please advise us at least four weeks in advance, enclosing the address label from a recent issue. Send change of address notice to:

Mutual Funds / ETFs Update