Volume 18, Number 9

September, 2012 Single Issue $15.00

In this issue:

- What’s New

- ETF recommended list review

- Couch Potato Portfolio posts modest loss

- Protecting your investments in falling markets

- PIMCO takes Canada by storm

- RBC Monthly Income Fund options

- Reader Questions

What’s New

♦ Mutual Fund Sales surge in July – After a disappointing June, mutual funds came roaring back with a vengeance posting net sales of nearly $2.9 billion during July. It was again bond and balanced funds garnering the majority of investors’ attention. Investors continued to sell their equity funds, which saw yet another month of net redemptions. Total mutual fund assets were estimated at $803 billion on July 31.

♦ ETFs surpass $50 billion in assets – While still a fraction of the size of the mutual fund industry, ETFs continued to show impressive growth, surpassing the $50 billion mark for the first time in history. As with mutual funds, it was bond funds which attracted the bulk of new money, attracting $518 million in net sales during the month. Equity ETFs saw net redemptions to the tune of more than $150 million, mirroring the activity in mutual funds.

♦ National Bank Mutual Funds wins the emerging markets sweepstakes – On August 28, it was announced that Patricia Perez-Coutts, the former star manager of the AGF Emerging Markets Fund had signed on to manage the Omega Emerging Markets Fund, effective immediately. The name of the fund would be changed to the Westwood Emerging Markets Fund. It was also announced that plans were in the works to launch two new funds; the Westwood Global Equity Fund and the Westwood Global Dividend Fund. It is expected that the highly successful process that Ms. Perez-Coutts and her team employed at AGF would be used with the new funds. More details will be forthcoming in the next few weeks as more information becomes available.

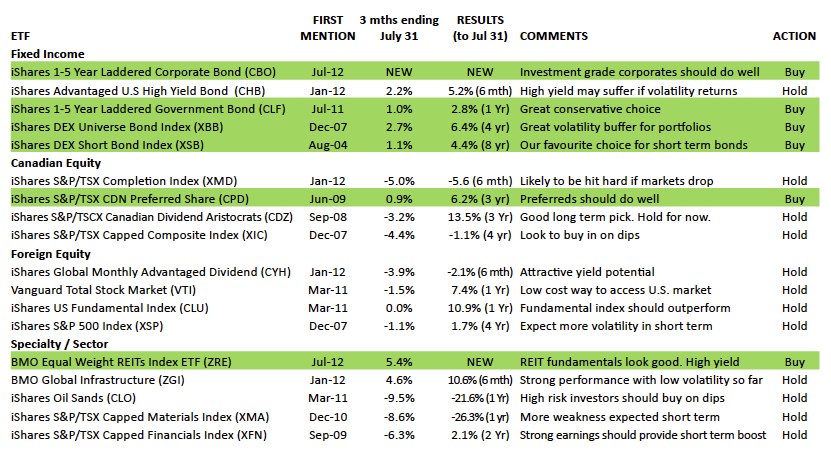

ETF RECOMMENDED LIST REVIEW

By Dave Paterson, CFA

For the fall, the best offense is a good defense

Despite market volatility taking a vacation throughout the months of July and August, we expect that it, like the rest of us will be back at full strength as we enter the fall. Many of the macro factors that have been responsible for the uncertainty in the past several months continue to weigh on the markets. Europe’s debt crisis is not any closer to having a workable solution in place. The U.S. economy is continuing to show some signs of recovery, with housing finally appearing to be on the upswing. While this is a very encouraging sign, it could all be derailed if the U.S. is allowed to fall off its “fiscal cliff.” The fiscal cliff is a mix of tax increases and spending cuts, that if allowed to be implemented will surely put the fragile recovery out of its misery. Also on the minds of investors, China and the emerging markets continue to post slower economic growth, which is affecting the demand for energy and commodities.

Given the current environment, combined with the history of September and October being nasty month for investors, we are taking a more conservative stance. In doing so, we are placing a bigger emphasis on fixed income. We believe that in the next couple of months, fixed income will provide investors with safe harbor during the heightened volatility. While there is no doubt that interest rates will have to move higher in the future, with the pace of economic growth being lackluster at best, there is virtually no chance that the Bank of Canada will have to step in and raise interest rates in the next three months.

We are not suggesting that investors sell their equity holdings. Instead, we are looking to take advantage of any market declines as an opportunity to add to our equity exposure.

Upgrades and New Additions

iShares 1-5 Year Laddered Corporate Bond (CBO) – This new addition to our Recommended List focuses on investment grade corporate bonds with maturities between one and five years. It has a duration of 3.89 years and a weighted average coupon rate of just under 4%. It is a nice compliment to the government focused CLF.

iShares S&P/TSX CDN Preferred Share (CPD) – Preferred shares can be a great way to add some equity exposure without taking on as much risk as is associated with traditional common shares. This ETF provides exposure to a diversified portfolio of preferred shares. The portfolio quality is high with more than half invested in preferreds that are rated P1 – the highest rating available. It pays investors a monthly distribution of $0.066 per unit, which translates into an annualized yield of 4.6% at current prices. We expect that this will hold up relatively well during periods of high volatility and still provide the monthly distribution.

BMO Equal Weight REITs Index ETF (ZRE) – We like the medium term fundamentals of the REIT market and we believe that this ETF is the best way to access the REIT market for Canadian investors. We like ZRE over the iShares S&P/TSX Capped REIT Index for two main reasons. First is that ZRE has a larger number of holdings providing better diversification over XRE. Second, it offers a higher yield than XRE. Costs are very comparable between the two ETFs.

Downgrades and Deletions

iShares Advantaged U.S High Yield Bond (CHB) – Despite downgrading this ETF to a HOLD, we still like it as a great way to add high yield to your portfolio for the long term. However, given our expectation of increased volatility in the fall, we are favouring investment grade and lower duration ETFs for the near term as we expect them to be outperform in the near term.

iShares S&P/TSX Completion Index (XMD) – Historically, when a market decline occurs, small and mid cap stocks tend to be hit the hardest. Because of this, we are downgrading this ETF to HOLD for the near term.

iShares S&P/TSX Canadian Dividend Aristocrats (CDZ) – While we don’t expect a drop in the markets like we witnessed in 2008, we do expect higher volatility. Because of that, we are very cautious of adding to any new equity positions at the moment. Therefore, we are downgrading this ETF to a hold for the near term.

iShares Global Monthly Advantaged Dividend (CYH) – We are expecting a return to high levels of volatility. Because of that, we are very reluctant to add t any new equity positions at the moment. Therefore, we are downgrading this ETF to a hold for the near term.

BMO Global Infrastructure (ZGI) – While we like this ETF as a long term play, it appears that it may have hit a near term high back in July. Given that, combined with our expectation of higher volatility, we are downgrading the fund to a HOLD for the near term.

COUCH POTATO PORTFOLIO POSTS MODEST LOSS

By Dave Paterson, CFA

Putting some perspective on the strategy’s performance

For many investors, the idea of a “Couch Potato Portfolio” made up entirely of ETFs has a great deal of appeal. After all, it’s simple to implement, offers lower cost than a portfolio of mutual funds, provides pure asset class exposure, is fully transparent, and can be more tax efficient than a comparable portfolio of mutual funds.

While the theory is sound and the appeal is undeniable, the question is always “does it work”? There really isn’t a definitive answer to that question. For example, we have had our Couch Potato Portfolio up and running for four and a half years, yet its performance hasn’t exactly shot the lights out. Since its launch, the portfolio has shown an annualized return of 1.9%, assuming all the dividends received were reinvested.

In comparison, a portfolio made up of four actively managed funds that I was recommending in 2008 would have posted an annualized gain of 2.6% including all reinvested dividends. The funds I used for this exercise were PH&N Bond, Dynamic Value Fund of Canada, CI American Value and Mutual Global Discovery. Judging by the since inception numbers, the more active strategy is the way to go, right?

Well, not so fast. If we look at the performance of both of the portfolios since the February 2009 market low, the clear winner has been the ETF Couch Potato Portfolio. Since the February low, the ETF Couch Potato has posted an annualized gain of 10.3% while the comparable portfolio of mutual funds gained only 8.3%. This big difference in performance can be attributed to one main factor – the mutual fund portfolio weathered the 2008 market drop much better than the ETFs. Since market bottom, it has been ETFs that have bounced back more sharply than the funds.

To further complicate things, on a year to date basis, the mutual fund portfolio is outpacing our Couch Potato Portfolio. While this may help make determining a clear cut winner between the two strategies, it reinforces what we said in our last review of the Couch Potato Portfolio which was “…there may also be extended periods of time where the couch potato style of investing may lag an approach that is much more hands on. We believe that we are in one of those periods. We are experiencing periods of extreme market volatility and while things appear to have settled down slightly, there are still many headwinds and issues that remain unresolved. In this uncertain environment, it is our view that investors would be better suited using a more active strategy, either by making tactical shifts within their portfolios themselves or by investing in high quality, actively managed funds.”

We stand by that statement today. Based on our market forecasts, we believe that a more active strategy will outperform an index based approach in the next few months.

Here is the latest report on the couch potato portfolio performance. Results are based on the prices as of April 30, 2012.

| Fund | Shares Owned | Target Weight | Book Value | Market Value | Dividends Paid | Total Return since Inception |

| XBB | 140 | 40% | $4,019.40 | $4,426.80 | $793.44 | 29.88% |

| XIC | 140 | 30% | $3,015.30 | $2,574.60 | $305.84 | -4.47% |

| XSP | 82 | 15% | $1,489.94 | $1,288.22 | $79.09 | -8.23% |

| XIN | 55 | 15% | $1,500.40 | $880.00 | $120.15 | -33.34% |

| Totals | 100% | $10,025.04 | $9,169.62 | $1,298.52 | 4.42% |

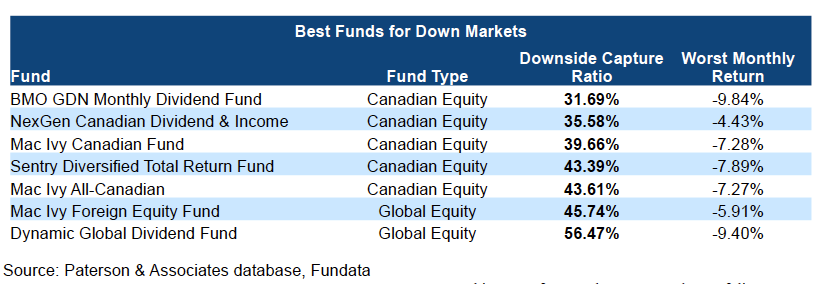

PROTECTING YOUR INVESTMENTS IN FALLING MARKETS

By Dave Paterson, CFA

The best core equity funds for a market drop

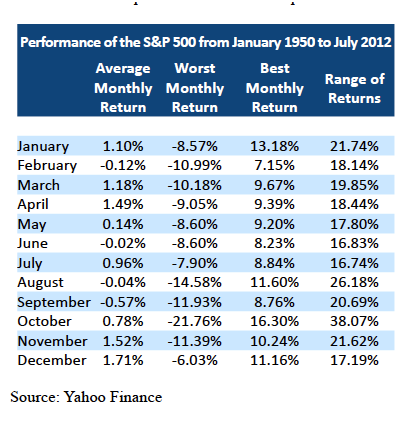

Quick – what has been the worst month for the stock market? If you’re like most people, you probably said October. With such memorable drops as “Black Tuesday” happening on October 29, 1929, and “Black Monday” occurring on October 19, 1987, it’s not surprising that most people pick October.

However, if we look at the historic returns of the S&P 500 over time, we see that it is actually September which has been the worst month for investors. Between January 1950 and July 2012, the average return in September was a loss of -0.57%. Somewhat surprisingly, October, which is perceived to be the worst month, has rewarded investors with an average monthly return of +0.78%. If we look at volatility, it has been October which has shown bigger drops. The biggest decline in October has been -21.76% compared to -11.23% for September.

Regardless of how one determines the best or worst month for investors, the next few months have the potential to be the most volatile months of the year. Considering the global environment, the likelihood of big market swings is only heightened. With the lingering debt crisis in Europe, the slowdown in China, the U.S. election and the potential for the U.S. “fiscal cliff” there will much uncertainty in the minds of investors.

Regardless of how one determines the best or worst month for investors, the next few months have the potential to be the most volatile months of the year. Considering the global environment, the likelihood of big market swings is only heightened. With the lingering debt crisis in Europe, the slowdown in China, the U.S. election and the potential for the U.S. “fiscal cliff” there will much uncertainty in the minds of investors.

The challenge then becomes positioning your portfolio in the most appropriate manner. Obviously, the best way to avoid any market swings is to remain invested in cash or even fixed income. For most investors though, making that move just doesn’t make sense. First, most will need at least some equity exposure to help provide some investment return in their portfolios. Second, while the likelihood of a big market drop exists, it is far from a sure thing, and by being fully in cash you will have missed out on any gains which may occur.

With that in mind, we went out to find the best core equity funds to hold when markets drop. To determine this, we looked at a measure which is known as the “Downside Capture Ratio.” This measure shows how much of the market decline the fund has experienced when the benchmark has posted a losing month. If the ratio is lower than 100%, the fund has outperformed the benchmark in a falling market. If it is over 100%, the fund has underperformed the benchmark. In other words, a lower downside capture ratio is preferred to a higher ratio.

In ranking our fund universe, we looked at the performance for the most recent 60 month period ending July 31, 2012. Only funds that had a five year track record were included in our search. Other criteria that we used to screen the universe included a downside capture ratio of less than 66% and the fund could not have experienced a decline of more than 10% in any one month.

Our list of the funds which meet these criteria are:

BMO Guardian Monthly Dividend Fund (GGF 411) – This fund invests at least 60% of its assets in preferred shares. As of July 31, it held near the minimum allowed in preferreds and 31% in high yielding, blue chip Canadian equities. It pays investors a regular monthly distribution of $0.035 per unit.

NexGen Canadian Dividend & Income – Manager Rob McWhirter uses a bottom up, cash flow driven growth style in managing the fund. They invest in companies that have a history of paying dividends and can invest up to half the fund outside of Canada. Currently the entire fund is invested in Canada. Perhaps not surprisingly Financials make up the largest component of this fund. A unique twist is that NexGen offers the fund in a registered version and in a tax managed version. Within the tax managed version, investors have the option to select the type of income they would like to receive from the fund; capital gains, return of capital, dividend, or compound growth.

Mackenzie Ivy Canadian Fund (MFC 083) – The first of three Ivy entries on our list, the Ivy Canadian Fund invests in a concentrated portfolio of high quality businesses with strong balance sheets, quality management teams and that are generating healthy earnings. The managers have also not been afraid to take on higher than normal cash positions in periods where valuations are high. A couple of concerns that we have with this fund are that there has been significant management turnover since 2009 and the fund has been dreadful in rising markets. That said, downside protection is a key component of the Ivy brand and they do it better than almost anybody out there.

Sentry Diversified Total Return Fund (NCE 722) – This is a very actively managed fund that invests in Canadian and U.S. mid and large cap companies. Manager John Kim took over the lead manager duties of the fund in August of last year, taking over from Andrew McCreath. Portfolio turnover has been north of 100% in every year since 2009 and it has a very flexible mandate. It uses short selling on a regular basis, and can invest in leveraged and inverse ETFs. While volatility has been low on a historic basis, it does have the potential to be volatile. The fund is currently defensively positioned, holding 30% in cash and 11% in fixed income.

Mackenzie Ivy All Canadian Fund (MFC 1016) – This fund is very similar to the Ivy Canadian Fund, except that it invests exclusively in Canada.

Mackenzie Ivy Foreign Equity (MFC 081) – This has been one of our favourite global equity funds for the past couple of years. We like the Ivy approach for volatile times, but they tend to lag in rising markets. This fund has shown better numbers in rising markets than the Canadian focused mandates and is a great place for investors looking for conservative global exposure.

Dynamic Global Dividend Fund (DYN 031) – Managed by David Fingold who has long been one of our favourite managers, this fund looks for well managed companies that are capable of initiating or growing their dividends and are attractively valued. Long term performance numbers have been strong on a relative basis, outpacing the global equity category by a reasonable margin.

Bottom Line: I believe it was Warren Buffett who said that there are only two rules to investing. Rule number one is to never lose money. Rule number two, never forget rule number one. While losing money in the short term, particularly in equities can be a near impossible task. But there are equity funds that have done a great job preserving capital in down markets. By having some exposure to those funds in your portfolio, you put yourself in a better position to obey Buffett’s rule number one. Next month, we’ll take a look at some of the funds that have historically done well in rising markets.

PIMCO TAKES CANADA BY STORM

By Dave Paterson, CFA

A quick overview of fund giants Canadian offerings

With over $1.8 trillion in assets under management, Newport Beach based PIMCO is one of the world’s most respected money managers. Founded in 1971 by Bill Gross, Bill Podlich and Jim Muzzy, PIMCO was the first to bring the concept of an actively managed bond portfolio to the mainstream. Over the years, Bill Gross has become one of the most influential individuals when it comes to the topic of fixed income.

In managing portfolios, the firm employs an active strategy that incorporates both top down and bottom up strategies. They use a big picture overview to help them set the funds’ duration, yield curve positioning and sector exposure. Once this is set, they use their proprietary analytical approach to find undervalued securities that will allow the funds to provide strong risk adjusted returns.

Largely known as a fixed income shop, PIMCO has been expanding their lineup to include a number of equity focused offerings. A few years back, they landed Charles Lahr and Anne Gudefin, who were very successful in managing the Mutual Discovery Fund before their arrival at PIMCO.

Active in the institutional space in Canada since 2004, PIMCO launched eight mutual funds early last year that were targeted at individual investors. Playing to their strengths, six are fixed income focused, with the other funds being a global equity and a balanced fund.

While it is much too early to make a definitive judgment on the funds, early indications look promising. Except for the PIMCO Canadian Long Term Bond and the PIMCO Global Advantage Strategy Bond, the funds have finished well in the upper half of the category.

Some quick highlights of their fund offerings include:

PIMCO Canadian Short Term Bond (PMO 001) – As the name suggests, this is an actively managed portfolio of short and intermediate term Canadian bonds that looks to outpace the DEX Short Term Bond Index. As of July 31, it has done just that, posting a one year return of 3.2%, handily beating the index. The fund is conservatively positioned, holding 73% in government bonds and 22% cash. The cost is low, with an MER of 1.20%.

PIMCO Canadian Total Return Bond Fund (PMO 002) – This is a core bond fund that invests in an actively managed diversified portfolio of high quality Canadian bonds. Performance has been strong, finishing firmly in the top quartile. The focus is on high quality bonds, with more than 80% invested in government bonds. The duration is in line with the DEX Bond Universe, which means that when interest rates increase the fund will be affected similarly to the index. The management fee is 1.20% which is higher than some of our favourites including PH&N Total Return Bond and Beutel Goodman Income.

PIMCO Canadian Long Term Bond Fund PMO 003) – This is one of only a handful of funds in Canada that are focused exclusively on bonds that have a maturity of more than ten years. The longer term increases the interest rate sensitivity, which makes it more volatile than a more traditional bond fund. While this will help in a flat or falling rate environment, it will hurt when rates move higher. While we don’t expect rates to move higher anytime soon, we would not suggest an allocation to long term bonds at the moment.

PIMCO Canadian Real Return Bond Fund (PMO 004) – The managers are active in their approach to the fund and have the flexibility to invest in other types of bonds including high yield bonds, emerging market bonds and foreign bonds. Like long bonds, we would be reluctant to suggest a meaningful allocation to real return bonds given the current interest rate and inflation environment.

PIMCO Monthly Income Fund (PMO 005) – Early indications put this global bond offering at or near the top of the class for the PIMCO offerings. It invests in an actively managed portfolio of non-Canadian fixed-income instruments of varying maturities that seeks to maximize current income while maintaining a relatively low risk profile. To date, it has done that, providing very strong returns with very low volatility. In addition, it pays a regular monthly distribution that is around $0.041 to $0.046 per unit, which works out to an annualized yield of approximately 3.8%. While volatility has been low, it could head higher over time. It has a fairly flexible investment mandate and can invest up to 50% of the fund into high yield bonds, which can be risky. It also can invest up to 10% of the fund in gold and silver, which is not something you would expect from a bond holding.

PIMCO Global Advantage Strategy Bond Fund (PMO 006) – Another global bond offering, this fund has not delivered anywhere near the stellar results of the Monthly Income Fund. Since its launch, it has lagged most of the global bond category. There are a number of better offerings available including a couple of our favourites RBC Global Corporate Bond and Manulife Strategic Income.

PIMCO Global Balanced Fund (PMO 007) – Set up as a “fund of funds” solution, this global balanced offering invests in units of the PIMCO Global Advantage Strategy Bond Fund and the PIMCO Pathfinder Fund. The asset mix will typically be set at between 40% and 60% equity. As of July 31, the mix was roughly 50/50. Given the underperformance of the Global Advantage Bond Fund, this is one that investors may want to avoid in the near term.

PIMCO EqS Pathfinder Fund (PMO 008) – Managed by the team of Anne Gudefin and Charles Lahr, this bottom up, go anywhere equity fund uses a deep value approach in its stock selection. The fund may also use a couple of other nontraditional strategies to add value including investing in merger arbitrage and distressed debt. The portfolio is fairly diversified, holding approximately 90 names. Volatility has been comparable to the broader market. The biggest drawback to this fund is that the costs are higher than the category average.

BEST BETS – PIMCO Monthly Income, PIMCO Canadian Short Term Bond, PIMCO EqS Pathfinder Fund

RBC MONTHLY INCOME FUND OPTIONS

By Dave Paterson, CFA

Some good alternatives for registered accounts

Anybody who has followed this newsletter for a while knows that the RBC Monthly Income Fund has been one of our favourites. A quick look at the fund and it is not hard to see why. This low cost, conservatively managed balanced fund has rewarded investors with steady, stable performance that has consistently outpaced its benchmark and peer group. The only real drawback to this fund is that it is not available in registered plans.

RBC made the decision to close the fund to new contributions in registered plans back in December 2005. This was no doubt a difficult decision for the company as it had been the top selling fund in the country for the previous two years, and had just crossed the $7 billion mark. While the decision may have been difficult and potentially unfavourable with investors in registered plans, it was the right decision to make. At a certain level of assets, it becomes very difficult for the managers to implement their investment style and process, which often times can lead to a lack of flexibility that typically results in subpar performance. In looking at the top quartile performance it the fund has posted in every year except for 2009 and 2006 that is clearly not the case here.

While this has been great for existing investors in registered plans, it leaves any potential new investors out in the cold. With that in mind, we scoured the fund universe in search of a few options that may be a good alternative for the RBC Monthly Income Fund in Registered Plans.

BMO Monthly Income Fund (GGF 70148) – The BMO Monthly Income Fund is probably the most similar of all the funds we looked at. It has the objective of providing investors with a consistent level of monthly income and capital preservation. It invests in a mix of fixed income and high yielding equities such as dividend paying common shares and REITs. It pays investors a monthly distribution of $0.06 per unit, which works out to an annualized yield of nearly 10%. While we largely like the fund, there are a couple of concerns. First, the distribution is unsustainable at the current level without significantly eroding capital. However, for those reinvesting distributions in a nonregistered account, this isn’t as large a concern. The other issue is that long time manager Michael Stanley retired in March and the equity portion is now managed by Phil Harrington and Luis Zeitler.

Fidelity Monthly Income Fund (FID 269) – The fund looks to provide investors with a mix of income and capital gains. To do this, the fund invests in a mix of fixed income and high yielding equity investments. Unlike the BMO or RBC offerings, this fund will invest outside of Canada. As of July 31, more than 32% of the fund was in global securities. It has also been the most volatile and the most expensive, with an MER that is well above the RBC fund. Despite the higher costs, returns have been strong, posting top quartile performance for the past five years.

Mawer Balanced Fund (MAW 104) – The target asset mix of this high quality Mawer offering is the fairly typical 60% equity and 40% fixed income, which is a bit more aggressive than RBC. Unlike the other funds which invest in individual securities, this offering is a fund of fund solution that invests in a mix of other Mawer funds. It will invest globally, and as of July 31, held nearly 35% outside Canada. Despite this, volatility has largely been kept in check. The MER is very low, coming in at 0.98%. The biggest drawback of this fund is that the minimum investment is $5,000 which puts it out of reach for the smallest of investors.

Build your own – Using a couple of RBC funds, you can build your own portfolio that will have a risk reward profile that is very similar to that of the RBC Monthly Income Fund. Considering our analysis, a mix of 55% RBC Bond Fund and 45% RBC Canadian Dividend Fund should provide you a return that is comparable to the RBC Monthly Income Fund with similar volatility. The weighted average MER of the mix is 1.44%, which is slightly higher than the MER of the fund.

READER QUESTIONS

Corporate class funds can help reduce taxes

Question – What are the advantages of using a corporate class fund in non registered accounts?

Answer – Quite simply the main advantage of corporate class funds is lower taxes. This happens because their unique structure allows for a couple of neat features. They are:

i.) Tax Deferred Switching – When you invest in corporate class funds, you are able to switch between funds in the same mutual fund corporation (fund family) without triggering a taxable event. You can switch between the various corporate class funds as often as you like, as long as you stay invested in the mutual fund corporation. Only when you take your money out of the mutual fund corporation do you need to worry about the potential capital gains you may have earned from holding the funds. If you were using a traditional mutual fund, every time you switch between funds, it is treated as a sell and a buy for tax purposes. This means you may incur a capital gain with each transaction, which reduces the amount of money you keep invested in your account.

ii.) Reduced Taxable Distributions – With any mutual fund, it pays no income tax and must pay out all the net income that it earns to investors over the course of a year. This income is generated by such things as interest earned, dividends received and capital gains generated. The net income is offset by any expenses the fund may have such as management fees, operating expenses and the like. Within a corporate class structure, all the income earned across all the funds in the corporate offset all the expenses of all the funds. This will allow for the ability to spread income across a larger number of funds which will result in the potential for lower distributions for most investors. This will work quite well as long as the corporation doesn’t hold many funds that will generate significant amounts of interest income like bond funds. If it does, there may be higher levels of interest income which may result in distributions paid out to all investors within the corporation.

A big knock on corporate class funds was that they were more expensive than traditional funds by 20 to 40 basis points. That used to be the case, but in recent years, that cost differential has been virtually eliminated.

Many people will see the phrase “lower taxes” and want to jump into these funds right away. A word of caution – I would never suggest any investment be made for the sole purpose of reducing taxes. It needs to be an investment that is suitable for you and your objectives, it needs to fit within your portfolio and it needs to be a high quality investment. Fortunately, there are a wide range of high quality corporate class offerings available from a number of companies including CI, Mackenzie, Fidelity, Dynamic, TD and more recently RBC and PH&N.

Mutual Funds / ETFs Update

Editor and Publisher: Dave Paterson

Circulation Director: Kim Pape-Green

Customer Service: Katya Schmied, Terri Hooper

BuildingWealth’s Mutual Funds / ETFs Update is published monthly.

Copyright 2012 by Gordon Pape Enterprises Ltd. and Paterson & Associates

All rights reserved. Reproduction in whole or in part without written permission is prohibited. All recommendations are based on information that is believed to be reliable. However, results are not guaranteed and the publishers and distributors of Mutual Funds Update assume no liability whatsoever for any material losses that may occur. Readers are advised to consult a professional financial advisor before making any investment decisions. Contributors to the MFU and/or their companies or members of their families may hold and trade positions in securities mentioned in this newsletter. No compensation for recommending particular securities or financial advisors is solicited or accepted.

Mail edition: $139.95 a year plus applicable taxes. Add $30.00 for delivery outside Canada.

Electronic edition: $69.95 a year plus applicable taxes.

Single copies: $15.00 plus applicable taxes.

Reprint permissions: Contact customer service (416) 693-8526 or 1-888-287-8229

Change of address: Please advise us at least four weeks in advance, enclosing the address label from a recent issue. Send change of address notice to:

Mutual Funds / ETFs Update

16715-12 Yonge St. Suite 181, Newmarket, ON L3X 1X4

Customer service:

By mail to the address above.

By phone to Katya or Terri @ (416) 693-8526 or 1-888-287-8229

By email to customer.service@buildingwealth.ca